Introduction

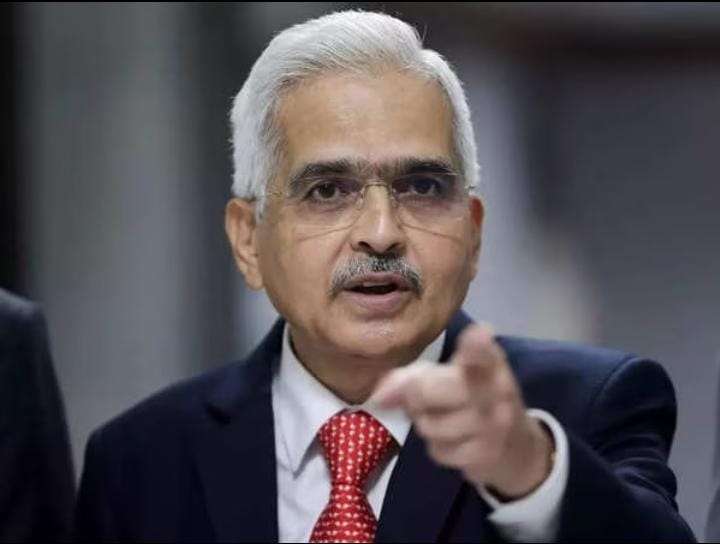

The Reserve Bank of India’s (RBI) Monetary Policy Committee (RBI MPC 2024) meeting is a focal point of interest as experts speculate on whether the Indian central bank will precede the US Federal Reserve in cutting rates. As the sixth consecutive meeting unfolds, led by RBI Governor Shaktikanta Das, the financial world is keenly observing the potential outcomes and the factors influencing the decision.

The Unexciting Markets

Despite the anticipation surrounding the RBI MPC 2024 meeting, there is a notable lack of excitement in the markets. The three-day deliberations commenced in Mumbai on February 6, marking the first MPC of 2024, following the presentation of the interim budget.

Status Quo: Unchanged Key Policy Rate

Experts predict that the RBI will maintain its key policy rate at 6.5%, unchanged for the sixth consecutive time. Madan Sabnavis, Chief Economist at the Bank of Baroda, underscores the high likelihood of the repo rate remaining unchanged.

RBI MPC 2024 Meeting’s Timeline

The three-day meeting initiated on Tuesday, with the outcome eagerly awaited on Thursday, February 8. This timeline sets the stage for decisions that could potentially impact the economic landscape.

Predictions and Insights

Repo Rate Outlook

Madan Sabnavis’s insights point towards a steady repo rate, aligning with the prevailing trend of unchanged rates. This projection suggests a conservative approach by RBI MPC 2024 in maintaining stability.

RBI’s Policy Pegged to the Fed

Madhavi Arora, Lead Economist at Emkay Global Financial Services Ltd., sheds light on the historical alignment of RBI’s policy with the US Federal Reserve. The policy shifts in the last two years, influenced by global factors, highlight the RBI’s commitment to ensuring financial stability.

Can RBI Precede the Fed?

Addressing the pivotal question of whether the RBI can precede the Fed in policy reversal, Madhavi Arora emphasizes the need for flexibility in response to global narratives. Despite the prevailing market conditions, a cautious approach is recommended, with predictions suggesting the Fed may not cut rates before June 2024.

Factors Influencing RBI’s Decision

- US Inflation Trends: The time required to discern US inflation trends influences the RBI’s decision-making process.

- Economic Resilience: The resilience of the Indian economy amid global uncertainties is a crucial factor.

- Financial Conditions: Easier financial conditions and their impact on demand play a role in shaping the RBI’s stance.

Based on the information provided, it seems that there are discussions and considerations regarding the monetary policy stance in the given economic context. Here are some key points:

- Possible Shift in RBI Stance: There is a discussion about the potential shift in the Reserve Bank of India’s (RBI) monetary policy stance from “withdrawal of accommodation” to “neutral.” This consideration is influenced by factors such as the Union Budget proposing a lower gross borrowing program for FY25.

- Inflation and Rate Reduction: The inflation forecast remains unchanged, and there is cautious optimism about a rate reduction in Q2-FY25, contingent upon favorable developments in inflation and the monsoon.

- Repo Rate and Liquidity Position: The RBI has indicated that a repo rate decrease is unlikely until headline inflation stabilizes at the 4% target. However, there might be a shift in the liquidity position to address concerns about interbank liquidity, which has worsened since the December 2024 MPC meeting.

- GDP Projections: Despite robust investment growth and positive economic indicators, there are concerns about slower consumer demand growth and challenges in the agricultural sector. There’s an expectation that the RBI may adjust the GDP projection for FY24 upwards.

- Liquidity Concerns: The lack of liquidity is identified as a worry, with a need for the RBI to be more aggressive on the liquidity front to address interbank market challenges.

- Proposed UPI-Enabled Gold-Linked Credit Line: There’s a suggestion for the introduction of a “gold-linked credit line via UPI” for the general public, potentially provided by Non-Banking Financial Companies (NBFCs). This product could function as a secured credit with a lower interest rate.

- Inflation Analysis: Headline inflation is at 5.7% in December, primarily driven by rising food costs. However, core inflation remains steady at less than 4%.

In summary, the discussions revolve around potential shifts in the RBI’s monetary policy stance, considerations for rate reduction, liquidity challenges, GDP projections, and innovative approaches to credit lines. The final decisions may depend on various economic indicators and global economic conditions.

FAQ Section

Q: Will the RBI change the repo rate in the upcoming RBI MPC 2024 meeting? A: According to Madan Sabnavis, Chief Economist at the Bank of Baroda, there is a high likelihood that the repo rate will remain unchanged.

Q: When is the expected outcome of the RBI MPC 2024 meeting? A: The outcome is due on Thursday, February 8, following the three-day meeting that commenced on Tuesday.

Q: What factors influence the RBI MPC 2024’s policy decisions? A: Madhavi Arora highlights global factors, US inflation trends, economic resilience, and easier financial conditions as key influencers.

Q: Can the RBI precede the US Fed in cutting rates? A: Madhavi Arora suggests a cautious approach, predicting that the RBI may follow the Fed with a lag, not preceding it in any policy reversal in CY24.

Q: Why is there not much excitement in the markets for the RBI MPC 2024 meeting? A: The anticipation is subdued, possibly due to the expectation of the key policy rate remaining unchanged for the sixth consecutive time.

Q: What is the significance of the first RBI MPC 2024? A: The first RBI MPC 2024 of the year is crucial, occurring after the presentation of the Interim Budget, setting the tone for economic policies.

Conclusion

As the RBI’s MPC 2024 meeting unfolds, the financial landscape awaits the decision that could shape economic policies. The cautious approach and alignment with global factors emphasize the need for stability in uncertain times. The insights provided by experts offer valuable perspectives, guiding expectations in the financial realm.RBI MPC 2024

Open Your Demat Account with Discount Brokers:

ZERODHA 1) : https://zerodha.com/open-account?c=EJ4366

Angelone 2) : https://tinyurl.com/2gloc3g6 or

Upstox3): https://link.upstox.com/9w4tNo1rK8au7VK47