REVIEW

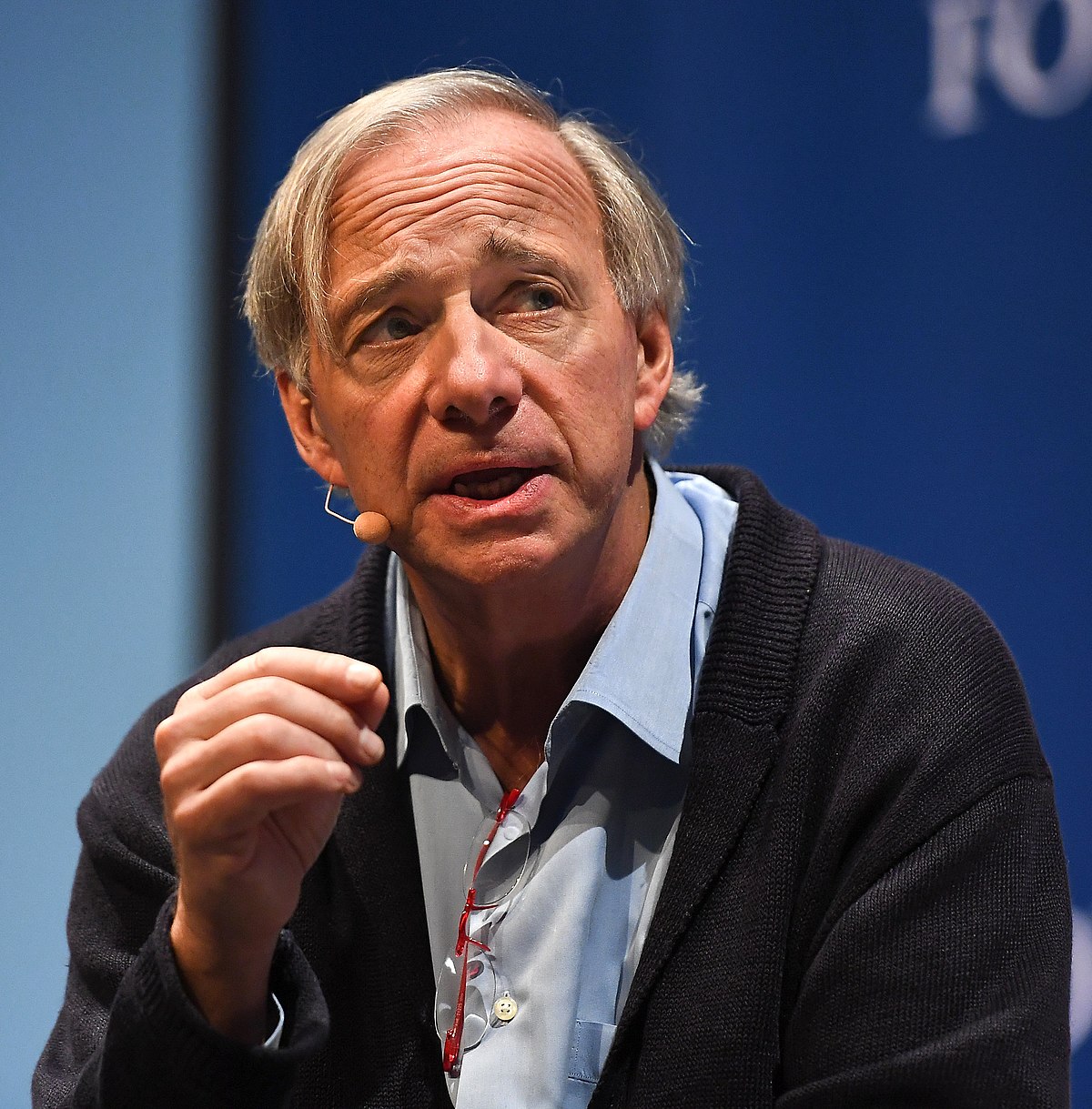

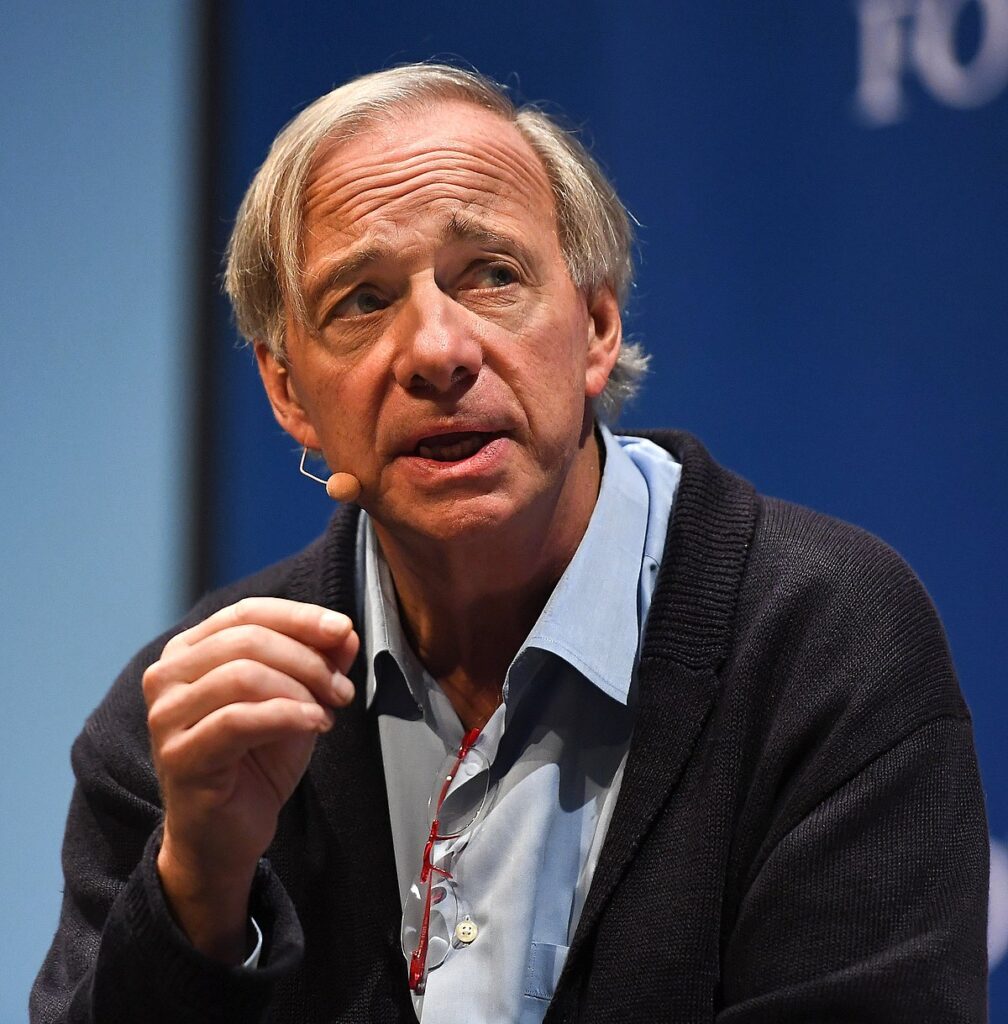

Discover why billionaire Ray Dalio, with over 50 years of investing experience, asserts that the market is not in a bubble. Explore his criteria and insights, debunking concerns and providing an optimistic outlook.

Ray Dalio, Founder, Co-Chief Investment Officer & Co-Chairman, Bridgewater Associates

Introduction:

In a recent LinkedIn post titled ‘Are We in a Stock Market Bubble?’ Ray Dalio, the seasoned billionaire and founder of Bridgewater Associates LP, delves into his extensive investing experience to analyze current market trends. Despite a significant equity rally, Dalio’s readings suggest that the market is not in a bubble. Let’s explore the key factors and insights that support his perspective.

Market Bubble Criteria: Decoded

High Prices Relative to Traditional Measures

Ray Dalio defines a bubble with high prices relative to traditional value measures. He evaluates assets by considering the present value of their cash flows against interest rates. Despite the rally, Dalio finds the United States market doesn’t exhibit overly high prices.

Unsustainable Conditions

Unsustainable conditions, such as extrapolating past growth rates late in the cycle, mark a bubble. Ray Dalio notes that current conditions, even with significant growth, do not indicate an inability to sustain that growth, contradicting bubble characteristics.

New and Naïve Buyers

A bubble often attracts new and naïve buyers due to a perceived hot market. Ray Dalio’s analysis reveals that the recent market surge hasn’t solely drawn in inexperienced investors, countering a typical bubble scenario.

Broad Bullish Sentiment

For a bubble, broad bullish sentiment is crucial. Ray Dalio observes the market and asserts that the prevailing sentiment doesn’t align with typical bubble patterns, adding to the assurance that a bubble is not imminent.

Financed Purchases and Speculative Bets

High debt-financed purchases and speculative bets are red flags for a bubble. Dalio’s assessment of the United States market indicates that these factors are not overly present, further dispelling concerns of a market bubble.

Market not in a Bubble says Ray Dalio, Magnificent Seven Frothy on AI Concerns

Ray Dalio’s assessment extends beyond bubble concerns, encompassing broader market dynamics. The United States market, even in its rallied parts, does not align with past bubbles, according to the billionaire investor. His holistic approach and experience-driven analysis provide confidence in the market’s stability.

Alphabet and Meta: The Dynamic Duo

Delving into the specifics, Ray Dalio singles out Alphabet and Meta as the standout players. In his insightful assessment, he deems them “somewhat cheap,” injecting a note of optimism into the market narrative. These tech giants, according to Dalio, present an attractive proposition in terms of valuation.

Tesla: The Priced Pinnacle

However, not all members of the Magnificent Seven share the same fate in Dalio’s estimation. Tesla, with its soaring ambitions and innovations, finds itself labeled as “somewhat expensive.” The electric vehicle pioneer stands at the pinnacle of the group, commanding attention but at a higher cost.

Balancing Act: Fair Pricing in Aggregate

Zooming out to view the Magnificent Seven as a collective force, Ray Dalio coins the term “fairly priced.” He underscores the delicate balance that the group maintains concerning market valuation. Despite individual variations, the aggregate positioning of these tech behemoths aligns with market expectations, as the market cap of the basket has surged by over 80 percent since January 2023.

Market Dynamics: A Delicate Equilibrium

Dalio’s insights extend beyond mere numbers; he highlights the symbiotic relationship between market cap growth and earnings. The Magnificent Seven now constitutes over 25 percent of the S&P 500 market cap, indicating a significant influence on the broader market dynamics. This growth, according to Dalio, doesn’t push the group into a bubble but rather places it in the “frothy” territory.

Risks on the Horizon: Generative AI and Correction Potential

Despite the relatively stable outlook, Dalio sounds a cautionary note regarding the potential risks. He suggests that a significant correction might be on the horizon if generative AI fails to live up to the priced-in impact. While sentiments are bullish and leverage remains in check, the prospect of a correction looms, reminding investors of the delicate equilibrium in the tech stock realm.

FAQs

Are Dalio’s criteria foolproof in predicting market bubbles?

Dalio’s criteria are robust but not foolproof. While they provide a comprehensive assessment, market dynamics can still be unpredictable due to various external factors.

How does Dalio’s analysis impact investment decisions?

Dalio’s analysis can influence investment strategies by offering insights into market stability. Investors may use this information to make informed decisions based on their risk tolerance and financial goals.

Does Dalio’s perspective guarantee a market without future bubbles?

Dalio’s perspective offers confidence in current market conditions, but the future remains uncertain. Continuous monitoring and adaptation to evolving market dynamics are essential.

Why is Dalio’s experience crucial in assessing market bubbles?

Dalio’s over 50 years of experience provide a historical context and deep understanding of market cycles, enhancing the reliability of his assessments.

Is Dalio optimistic about the market’s future?

While not explicitly stated, Dalio’s analysis implies an optimistic outlook, suggesting that the current market conditions are not indicative of an imminent bubble.

How can investors use Dalio’s insights in their decision-making?

Investors can incorporate Dalio’s insights by considering the factors he identifies when evaluating market conditions. This can contribute to a more informed and nuanced investment approach.

Conclusion:

As we ride the waves of these captivating market narratives, let Ray Dalio’s wisdom be the compass guiding us through the dynamic currents. The Magnificent Seven, each playing a unique tune, create a market symphony that, when understood through Dalio’s lens, becomes a source of strategic advantage.

In closing, the road ahead is illuminated by Dalio’s vision. Investors, armed with insights, can navigate the market with confidence, knowing that the Magnificent Seven are not merely actors on the stage but strategic players in a dynamic, ever-evolving market landscape.

Open Your Demat Account with Discount Brokers:

ZERODHA 1) : https://zerodha.com/open-account?c=EJ4366

Angelone 2) : https://tinyurl.com/2gloc3g6 or

Upstox3): https://link.upstox.com/9w4tNo1rK8au7VK47