REVIEW

Explore the latest Sensex highlights: Sensex closes up 300pts, Nifty at 22,200; Realty, IT gain, O&G, PSU Bank fall. Dive into key market movements, FII & DII activities, NSE F&O ban list, and global market insights.

Introduction:

In the dynamic world of financial markets, staying updated with the latest information is crucial for investors. This article provides an in-depth analysis of the Sensex today, highlighting its closing points, Nifty performance, sector-wise movements, and international market trends. Let’s navigate through the intricacies of the financial landscape.

Sensex Ends Up 300pts, Nifty at 22,200; Realty, IT Gain, O&G, PSU Bank Fall

The Indian stock market witnessed a notable surge as the Sensex closed up by 300 points, reaching new heights. The Nifty, not far behind, stood at an impressive 22,200. Let’s delve into the factors influencing these market movements.

Sensex Rally: A Closer Look

The Sensex’s remarkable 300-point surge is indicative of a bullish market sentiment. Investors have responded positively to various catalysts, such as robust corporate earnings, favorable economic indicators, and optimistic market dynamics.

Nifty Performance: Scaling New Heights

Nifty, mirroring Sensex’s upward trajectory, has reached a substantial level at 22,200. This milestone reflects the overall strength of the market, instilling confidence among investors.

Sector-wise Analysis: Winners and Losers

Examining sectoral performance provides insights into the market’s pulse. In this context, the realty and IT sectors celebrate gains, while oil & gas and PSU banks experience a downturn. Understanding these sectoral shifts is vital for making informed investment decisions.

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) Activities

Understanding the activities of FIIs and DIIs is pivotal in deciphering market trends and anticipating future movements.

FIIs Activity: Net Selling Worth ₹285.15 Crore

Foreign institutional investors engaged in net selling, offloading shares valued at ₹285.15 crore. Analyzing the reasons behind this move unveils broader market sentiments and potential areas of concern.

DIIs Activity: Offloading ₹5.33 Crore on February 26

On the domestic front, institutional investors offloaded stocks worth ₹5.33 crore on February 26. Exploring the reasons behind domestic sell-offs aids investors in gauging market stability.

NSE F&O Ban List: Companies in Focus

Notable Inclusions: Aditya Birla Fashion & Retail, Balrampur Chini Mills, Canara Bank, SAIL, Zee Entertainment Enterprises

The NSE F&O ban list for February 27 features prominent companies like Aditya Birla Fashion & Retail, Balrampur Chini Mills, Canara Bank, SAIL, and Zee Entertainment Enterprises. Understanding the implications of these inclusions is crucial for market participants.

Global Market Insights: A Holistic View

European Shares and Pan-European STOXX 600

European shares experienced a slight uptick, driven by gains in basic resources shares and positive earnings. The pan-European STOXX 600 reflected this upward trend, rising by 0.1% by 8:21 GMT.

Asian Shares and Tokyo’s Nikkei

Asian shares, however, slipped due to slightly warmer-than-expected Japanese inflation. Tokyo’s Nikkei, though reaching a fresh record high, closed just 0.01% firmer. Understanding the nuances of the Asian market is vital for global investors.

U.S. Market Radar: Durable Goods, Consumer Confidence, and Home Prices

Later in the day, U.S. investors kept a keen eye on durable goods sales, consumer confidence, and home prices. These factors play a significant role in shaping the global economic landscape.

Brent Crude Futures and International Developments

Brent crude futures hovered around $82.63 a barrel, influenced by reports of a draft Gaza truce proposal. The interconnectedness of global events underscores the importance of tracking international developments for market participants.

Market Futures: S&P 500, Nasdaq, FTSE, and European Futures

S&P 500, Nasdaq, FTSE, and European futures experienced marginal declines, showcasing the interplay of global financial markets. Understanding these trends provides investors with a comprehensive outlook.

U.S. Treasury Yields: A Close Look

Ten-year U.S. Treasury yields observed a 1.4 basis points decrease, while two-year yields fell 3 bps to 4.71%. Analyzing these yield movements is crucial for understanding shifts in investor sentiment and market expectations.

FAQs (Frequently Asked Questions)

Q: What contributed to Sensex’s 300-point surge? The Sensex’s surge can be attributed to factors like robust corporate earnings, positive economic indicators, and an overall bullish market sentiment.

Q: Why did FIIs engage in net selling? FIIs engaged in net selling, offloading shares worth ₹285.15 crore, potentially influenced by global economic factors and market adjustments.

Q: Which companies are on the NSE F&O ban list for February 27? Notable companies on the NSE F&O ban list include Aditya Birla Fashion & Retail, Balrampur Chini Mills, Canara Bank, SAIL, and Zee Entertainment Enterprises.

Q: How did international markets react on the same day? European shares slightly increased, while Asian shares slipped due to warmer-than-expected Japanese inflation. U.S. futures and international markets experienced marginal declines.

Q: Why did Brent crude futures hover around $82.63 a barrel? Brent crude futures were influenced by reports of a draft Gaza truce proposal, showcasing the impact of geopolitical events on commodity prices.

Q: What were the key U.S. market indicators to watch on the same day? Investors closely monitored U.S. durable goods sales, consumer confidence, and home prices to gauge the health of the U.S. economy.

Unveiling Centum Electronics: A Small-Cap Stock Triumph

Is Centum Electronics the Investment Gem You’ve Been Waiting For?

In the dynamic world of stock markets, finding the hidden gems can be the key to lucrative returns. Today, we delve into the success story of Centum Electronics, a small-cap stock that has astoundingly transformed ₹1 lakh into ₹3.5 lakh in just a year. The burning question: Should you consider investing now?

Centum Electronics’ Meteoric Rise

A Multibagger Journey: 254%, 364%, and 416% Returns in 1, 3, and 5 Years

Centum Electronics’ share price has been on a stellar trajectory, showcasing multibagger returns over the long term. In the last 1 year alone, the stock has soared by an impressive 254%, starting from ₹567.95. Zooming out to a broader perspective, the numbers become even more enticing – a remarkable 364% surge in the last 3 years and an astounding 416% jump in the last 5 years.

The Compelling Math: Turning Investments into Wealth

₹1 Lakh Investment Turned into ₹3.54 Lakh in a Year

For the savvy investor, here’s the enticing mathematics. An investment of ₹1 lakh in Centum Electronics a year ago would now stand tall at ₹3.54 lakh. Extend the time horizon, and the results are equally enticing – the same investment made 3 years ago would have resulted in ₹4.64 lakh, and 5 years ago, an impressive ₹5.16 lakh.

The Genesis of Centum Electronics

From Bangalore Roots to Global Heights

Founded in 1994 in the vibrant city of Bangalore, India, Centum Electronics has rapidly evolved into a diversified electronics powerhouse. With a global footprint spanning North America, EMEA, and Asia, the company stands as a testament to relentless growth. Offering a diverse range of products and services across various industry segments, Centum has strategically invested in enhancing its design and product development capabilities, coupled with profound domain knowledge in its operational segments.

Sensex Today Live: Sector Indices Heat Map

A Glimpse into Sector Dynamics

In the ever-evolving landscape of the stock market, today’s Sensex live report reveals notable movements across sectors. Realty, Consumer Durables, Healthcare, Pharma, IT, and Auto sectors take the lead, creating an intriguing heat map for investors to analyze and strategize.

Dive into the Financial Pulse: Sensex Today Live Update

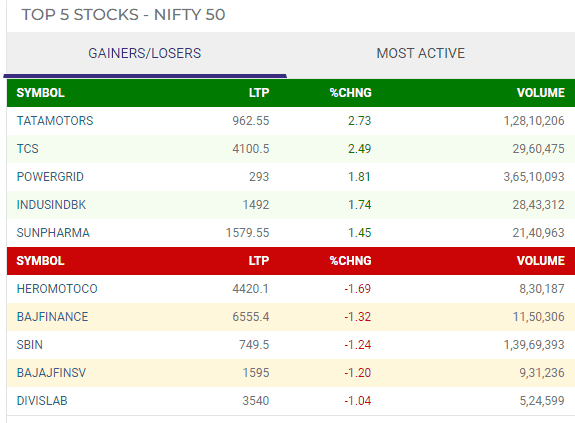

In the dynamic world of finance, staying abreast of the latest market movements is crucial for investors. Today, let’s explore the live performance of Sensex, highlighting both the gainers and losers on the Nifty 50.

Gaining Ground: Top Performers

1. TCS (Tata Consultancy Services)

Leading the pack of gainers, TCS showcased a remarkable performance, creating ripples in the market. Investors witnessed an upswing, reflecting the strength of this IT giant.

2. Tata Motors

Accelerating towards success, Tata Motors emerged as a significant gainer on the Nifty 50. A closer look at their market moves reveals a positive trajectory, signaling optimism among stakeholders.

3. Sun Pharma

Illuminating the market with gains, Sun Pharma added a bright spark to the Sensex today live update. Pharmaceutical sectors often play a pivotal role, and Sun Pharma’s ascent underscores its prominence.

4. Power Grid Corp.

Powering up the market, Power Grid Corp. secured a notable position among the gainers. Exploring the dynamics of the energy sector becomes imperative as it influences broader economic trends.

5. IndusInd Bank

The banking sector witnessed a surge with IndusInd Bank making substantial gains. Understanding the nuances of financial institutions is crucial for investors navigating the ever-changing market landscape.

Facing Headwinds: Top Losers

1. Bajaj Finance

Encountering a dip in fortunes, Bajaj Finance faced challenges on the Nifty 50. Examining the reasons behind such fluctuations provides valuable insights into the financial sector’s intricacies.

2. Hero MotoCorp

In the fast lane of market dynamics, Hero MotoCorp experienced a setback. Unraveling the reasons behind the decline sheds light on the automotive industry’s current challenges.

3. SBI (State Bank of India)

As a prominent player in the financial arena, SBI grappled with losses in today’s market. A closer examination of banking trends aids investors in making informed decisions.

4. Divi’s Lab

The pharmaceutical sector, though dynamic, also faces downturns. Divi’s Lab navigated through challenges today, emphasizing the need to comprehend the intricate nature of healthcare markets.

5. UPL (United Phosphorus Limited)

Completing the list of top losers, UPL faced headwinds in today’s market. Delving into the agriculture and chemicals sector provides a comprehensive understanding of the factors influencing UPL’s performance.

Navigating Market Dynamics: A Investor’s Perspective

In the ever-evolving financial landscape, understanding the winners and losers on the Nifty 50 is instrumental. Investors, armed with this information, can make informed decisions, ensuring they ride the waves of market trends.

Conclusion

Navigating the intricacies of the financial landscape is crucial for investors seeking to make informed decisions. This comprehensive overview of Sensex Today provides a holistic understanding of market movements, international influences, and sectoral dynamics. Stay tuned to these insights for a strategic approach to your investment journey.

Open Your Demat Account with Discount Brokers:

ZERODHA 1) : https://zerodha.com/open-account?c=EJ4366

Angelone 2) : https://tinyurl.com/2gloc3g6 or

Upstox3): https://link.upstox.com/9w4tNo1rK8au7VK47