Review: Stay updated with the latest Sensex and Nifty trends. Sensex jumps 320 points, with Nifty over 22,140. Get insights into the stock market updates, foreign institutional investments, F&O ban list, and global market trends.

Introduction

In the dynamic world of finance, staying updated with live market updates is crucial. The Sensex and Nifty indices are bellwethers of the Indian stock market, reflecting the pulse of investors and economic indicators. Let’s delve into the recent movements and key developments in the financial landscape.

Sensex Today | Share Market Live Updates

The Sensex witnessed a significant surge, jumping 320 points, propelled by gains across sectors like Oil & Gas, Media, and IT. Concurrently, Nifty crossed the 22,140 mark, showcasing a robust performance.

Global Market Trends

Global markets echoed optimism, with shares hovering near record highs. European markets, including the STOXX 600 and Germany’s DAX, marked consecutive gains, fueled by positive corporate updates. Meanwhile, the US stock index futures rose ahead of crucial economic data releases.

Investor Sentiment

Investors maintained a cautious stance amid anticipation of interest rate shifts. With the Federal Reserve meeting on the horizon, speculations loom regarding potential rate cuts, indicating a dynamic market sentiment.

Commodities Update

Commodities showcased mixed trends, with Brent crude rising while gold experienced a slight dip. These fluctuations often reflect broader economic dynamics and geopolitical factors impacting global trade.

Sensex Today | Share Market Live Updates

Institutional investment activities play a pivotal role in market movements. Recent data revealed contrasting behaviors, with foreign institutional investors (FIIs) net selling shares worth ₹4,595.06 crore, while domestic institutional investors (DIIs) purchased stocks worth ₹9,093.72 crore, signifying diverse investor sentiments.

F&O Ban List

The NSE F&O ban list for March 14 featured prominent entities like RBL Bank, Aditya Birla Fashion & Retail, and Zee Entertainment Enterprises. Such listings often indicate regulatory interventions or market volatility.

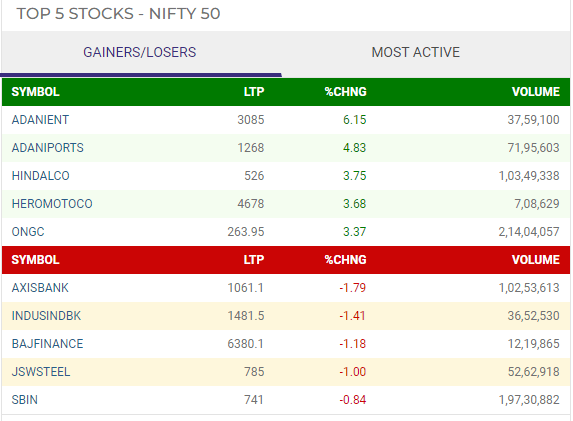

Sensex Today Live : Gainers and Losers on Nifty

Sensex’s current status unveils a dichotomy of winners and losers on Nifty’s esteemed list. Among the ascendants stand Adani Enterprises, Adani Ports & SEZ, Hero MotoCorp, Hindalco, and HCL Tech, heralding triumph in their respective domains. Conversely, Axis Bank, IndusInd Bank, JSW Steel, Tata Steel, and SBI face the brunt of market forces, grappling with setbacks in their ventures. This Nifty 50 tableau reflects the perpetual flux of financial realms, where fortunes sway with every tick of the market’s clock. In this intricate dance of gains and losses, each entity navigates the turbulent waters of uncertainty, striving for stability amidst the tempestuous currents.

FAQs

- What is the significance of Sensex and Nifty in the stock market? Sensex and Nifty are key stock market indices in India, representing the performance of top companies listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), respectively. They serve as benchmarks for market trends and investor sentiments.

- How do institutional investments influence market dynamics? Institutional investors, comprising FIIs and DIIs, wield significant influence in the market. Their buying and selling activities reflect broader market sentiments and impact stock prices, contributing to market volatility and liquidity.

- What factors drive global market trends? Global market trends are influenced by a multitude of factors, including economic indicators, geopolitical events, corporate performances, and central bank policies. These dynamics collectively shape investor sentiments and market movements.

- Why are commodities considered essential in financial analysis? Commodities, such as crude oil and gold, are integral components of financial markets. They serve as indicators of economic health, inflationary pressures, and geopolitical risks, offering insights into broader market dynamics.

- How do regulatory actions like the F&O ban list affect investors? Regulatory interventions, like the F&O ban list, often impact investor sentiments and market liquidity. Such actions may restrict trading activities on specific securities, influencing investor strategies and market volatility.

- What role do central bank meetings play in financial markets? Central bank meetings, like the Federal Reserve’s, are closely monitored by investors for policy decisions regarding interest rates and monetary policies. These meetings provide insights into future economic trajectories, influencing market sentiments and asset prices.

Conclusion

Staying abreast of real-time market fluctuations holds paramount importance for investors traversing the constantly shifting financial terrain. The dynamic interplay of market indicators such as Sensex and Nifty, which mirror both market sentiments and institutional maneuvers, underscores the significance of comprehending these intricate dynamics. Armed with this understanding, investors are empowered to wield informed discernment in their decision-making processes.

Open Your Demat Account with Discount Brokers:

ZERODHA 1) : https://zerodha.com/open-account?c=EJ4366

Angelone 2) : https://tinyurl.com/2gloc3g6 or

Upstox3): https://link.upstox.com/9w4tNo1rK8au7VK47