Introduction

The Reserve Bank of India (RBI) recently announced its latest monetary policy decisions on August 8, 2024. These decisions, which include keeping the repo rate unchanged at 6.5%, have significant implications for the Indian economy. In this article, we delve into the details of the announcements, their impact, and what they mean for the future.

RBI Monetary Policy Live Updates

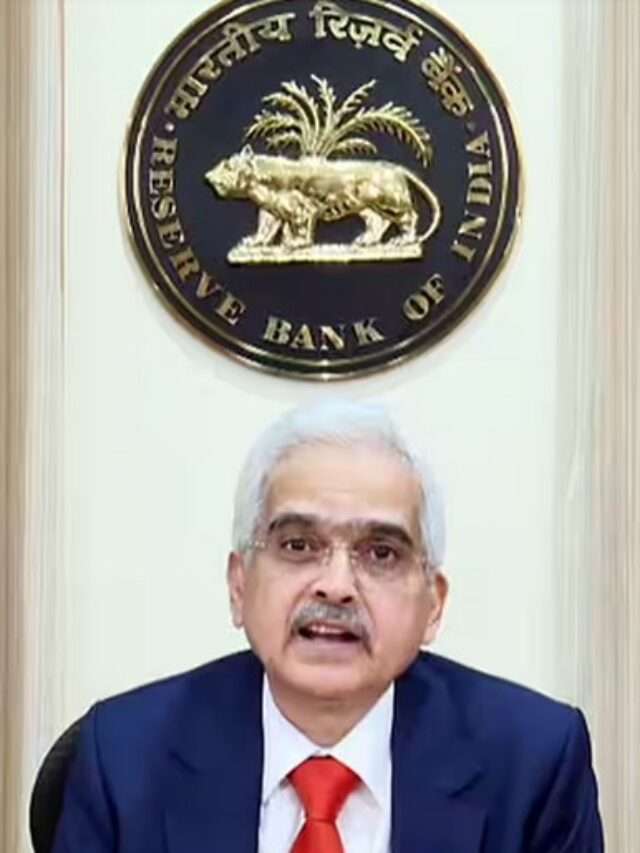

The RBI Governor Shaktikanta Das-led six-member Monetary Policy Committee (MPC) convened from August 6 to August 8 for their third bi-monthly policy meeting for FY25. The highlight of this meeting was the decision to keep the benchmark repo rate steady at 6.5%, marking the ninth consecutive meeting with no change.

Unchanged Repo Rate at 6.5%

The repo rate, which is the rate at which the RBI lends money to commercial banks, is a critical tool for controlling inflation and stimulating economic growth. By keeping this rate unchanged, the RBI aims to balance growth and inflation, ensuring economic stability.

Economic Impact of Unchanged Repo Rate

An unchanged repo rate has a direct effect on the cost of borrowing and lending. For businesses, this means that loan rates remain stable, encouraging investment and expansion. For consumers, home and auto loan rates are not expected to rise, keeping monthly installments affordable.

GDP Growth Projections for FY25

The RBI retained its real GDP growth projection for FY25 at 7.2%, with the quarterly breakdown as follows:

- Q1FY25: 7.1%

- Q2FY25: 7.2%

- Q3FY25: 7.3%

- Q4FY25: 7.2%

Q1FY25 GDP Projection

The GDP growth projection for Q1FY25 has been revised downward to 7.1% from the earlier estimate of 7.3%. This slight adjustment reflects various economic factors, including global market conditions and domestic economic activity.

Subsequent Quarters Projections

For the remaining quarters, the RBI has maintained its projections, indicating a steady economic growth trajectory:

- Q2FY25: 7.2%

- Q3FY25: 7.3%

- Q4FY25: 7.2%

Inflation Forecasts

The RBI has maintained its Consumer Price Index (CPI) inflation forecast for FY25 at 4.5%. This forecast reflects the RBI’s confidence in managing inflationary pressures effectively.

Quarterly Inflation Projections

The quarterly breakdown of the inflation forecast is as follows:

- Q1FY26: 4.4%

Policy Stance: Withdrawal of Accommodation

The RBI continues with its policy stance of ‘withdrawal of accommodation,’ indicating a cautious approach to monetary policy. This stance aims to normalize the extraordinary measures taken during the pandemic while ensuring that economic growth remains on track.

Decision Making in the MPC

The MPC, comprising six members, plays a pivotal role in setting the country’s monetary policy. The recent decision to keep the repo rate unchanged was made by a 4:2 majority, highlighting the diverse views within the committee.

Majority Decision on Repo Rate

The 4:2 voting outcome indicates a majority consensus on maintaining the current repo rate. This decision is crucial for maintaining economic stability and controlling inflation.

Other Key Announcements

Alongside the repo rate, the RBI also kept the Standing Deposit Facility (SDF) rate at 6.25% and the Marginal Standing Facility (MSF) rate and the bank rate at 6.75%. These rates play a vital role in the overall financial system, influencing liquidity and market rates.

Future Outlook

Looking ahead, the RBI’s cautious approach suggests that any future rate changes will be gradual and carefully considered. The focus will remain on balancing growth with inflation control, ensuring a stable economic environment.

Conclusion

The RBI’s decision to keep the repo rate unchanged at 6.5% reflects a balanced approach to monetary policy. By maintaining stable borrowing costs and projecting steady GDP growth, the RBI aims to support the economy’s recovery while keeping inflation in check. As we move forward, the central bank’s careful monitoring and strategic decisions will be crucial in navigating the economic landscape.

FAQs

- Why did the RBI keep the repo rate unchanged?

- The RBI aims to balance economic growth with inflation control, maintaining stability in the financial system.

- How does the repo rate affect the common man?

- The repo rate influences loan rates for consumers, affecting the affordability of home and auto loans.

- What is the significance of the GDP growth projection?

- The GDP growth projection indicates the expected economic performance, guiding investment and policy decisions.

- How does inflation impact the economy?

- Inflation affects purchasing power and cost of living. Controlling inflation is crucial for economic stability.

- What is the ‘withdrawal of accommodation’ policy stance?

- This stance refers to the gradual normalization of monetary policy after the extraordinary measures taken during the pandemic.

Open Your Demat Account with Discount Brokers:

ZERODHA 1) : https://zerodha.com/open-account?c=EJ4366

Angelone 2) : https://tinyurl.com/2gloc3g6 or

Upstox3): https://link.upstox.com/9w4tNo1rK8au7VK47

Wow amazing blog layout How long have you been blogging for you made blogging look easy The overall look of your web site is magnificent as well as the content

My brother suggested I might like this website He was totally right This post actually made my day You cannt imagine just how much time I had spent for this information Thanks